Wetherspoon, its customers and employees have paid £6 billion of tax to the government in the last 10 years

In Wetherspoon’s 2023 financial year (12 months to July 2023), it generated £760.2 million in tax – about £1 in every £1,000 of ALL UK government taxes. The average tax generated per pub in 2023 was £920,000.

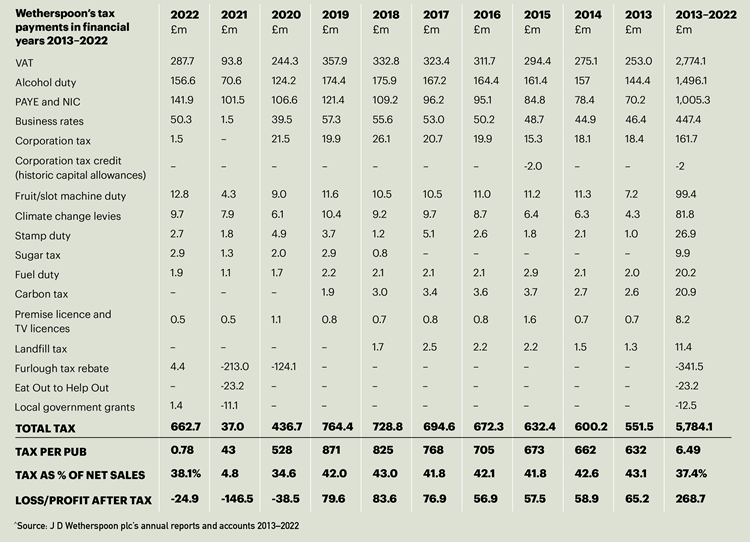

The table^ below shows the tax generated by the company in its financial years 2014–2023.

During this period, taxes amounted to about 39 per cent of every pound which went ‘over the bar’, net of VAT – about 25 times the company’s profit.

Wetherspoon’s finance director, Ben Whitley, said: “Pub companies pay enormous amounts of tax, but that is not always well understood by the companies themselves or by commentators, since most taxes are hidden in a financial fog.

“Wetherspoon has provided a table which illustrates the exact amounts of tax which the company, its customers and employees have generated, highlighting the importance of the hospitality sector to the nation’s finances.”

Wetherspoon’s chairman, Tim Martin, said: “The main long-term challenge to the pub industry is the tax disparity with supermarkets, which pay zero VAT in respect of food sales, whereas pubs pay 20 per cent.

“This disparity enables supermarkets to subsidise the selling price of beer, wine and spirits, to the detriment of pubs.

“Supermarkets also pay lower business rates per pint than pubs.

“A direct consequence is that pubs’ share of beer sales, for example, has dropped from 90 per cent to less than 50 per cent in recent decades.

“In fact, supermarkets are far more profitable than pubs – Tesco is probably more profitable than the entire pub industry.

“Even so, like Monty Python’s Dennis Moore, successive governments have robbed the poor (pubs) and given to the rich (supermarkets).

“A core principle of taxation is that it should be fair and equitable.

“Yet, most large pub companies in the UK have remained silent on this vital issue, as their most recent trading statements demonstrate.

“However, surveys by Wetherspoon in the past have demonstrated great fervour for tax equality among individual tenants and free traders.

“The lack of vocal support for equality is probably an example of boardrooms being out of touch with those on the front line, always a bad sign for any industry.

“Until there is tax equality between different types of business on the high street, pubs will always be fighting with one hand tied behind their back – and will provide less in the way of jobs or taxes than they otherwise might.”